Use case description

A large hedge fund in the States is using an in-house portfolio analysis and hedging solutions.

Portfolio analysis is a study of the performance of specific portfolios under different circumstances.

It includes the efforts made to achieve the best trade-off between risk tolerance and returns.

The analysis of a portfolio is usually conducted by a professional who utilizes specialized software.

Portfolio analysis involves quantifying the operational and financial impact of the portfolio.

It is vital to evaluate the performances of investments and timing the returns effectively.

The analysis of a portfolio extends to all classes of investments such as bonds, equities, indexes, commodities, funds, options and securities.

Portfolio analysis gains importance because each asset class has peculiar risk factors and returns associated with it.

Hence, the composition of a portfolio affects the rate of return of the overall investment.

Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment.

The hedge fund was looking for methods to improve their hedging, by analyzing historical data, looking for similar scenarios in the past

and making changes in the portfolio accordingly. 6 years of global stock data were used for this analysis and an international Exchange-Traded Fund (ETF) was used as a test case.

Our challange was to mine the historical data of the stocks, identify patterns, detect behaviors and hedge the tested ETF accordingly. The goal

was to successfully track the ETF using external stocks (that are not part of its holdings group).

Our analysis

The financial data that we analyzed included the daily price and volume of 3,000 global stocks, over a period of 6 years.

In addition, we had the daily price of the tested ETF and its holdings.

The conventional approach is to hedge based on sector membership of the ETF holdings.

We used our technologies for data mining, behavior analysis and pattern recognition to identify for a given period of time (for example, a week of

daily prices),

all the stocks that their historical behavior had the same pattern as the ETF or its holdings.

We built a portfolio that was based on those similar stocks and used it to track the ETF.

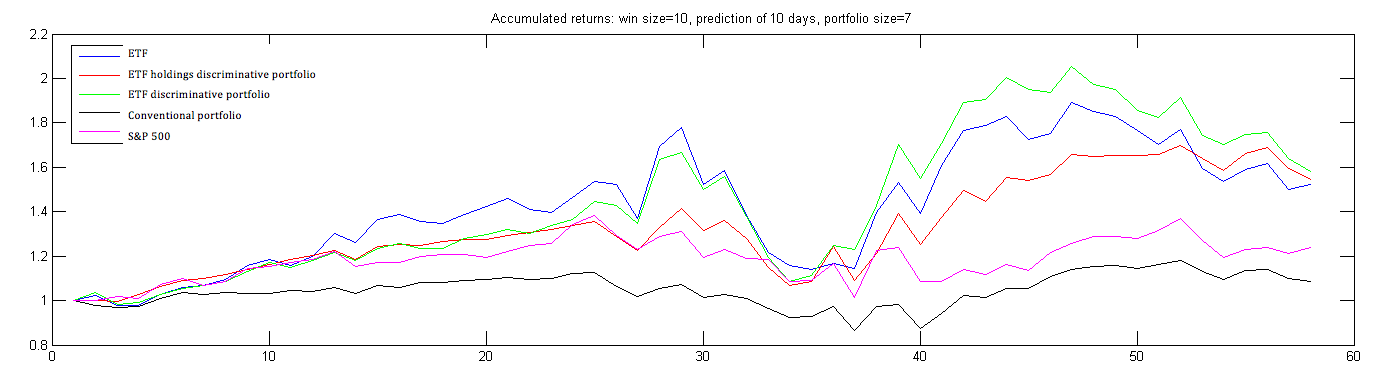

In the following example, we compared the accumulated return of the ETF (blue line), the portfolio that we built for the ETF itself (green line) and

for its holdings (red line) and the portfolio that

was built using the conventional approach (black line). The S&P 500 is presented as a reference (magenta line).

Our discriminatvie portfolios tracked successfully the ETF and outperformed the conventional approach.

Conclusions and our solution

We developed a portfolio and hedging technology that was evaluated by a large hedge fund. This technology was based

on our data mining, behavior analysis and pattern recognition methods. Our technology outperformed the

conventional approach that is used for hedging.